New Fund Members

According to Icelandic law, it is a general obligation to contribute to a pension fund from the age of 16. An employee pays 4% of his or her pay every month and an employer pays a counter-contribution, usually 11.5% of the pay in question.

By contributing to the fund, you accrue the right to a pension, thus preparing for the years after working age.

New fund members receive by mail text of the main items regarding the operation of the fund. Below you find an english translation:

Information letter for new fund members

Oparation of Stapi Pension Fund

Stapi Pension Fund has three divisions, Mandatory Division, Voluntary Division and Specific Voluntary Division.

Mandatory Divison

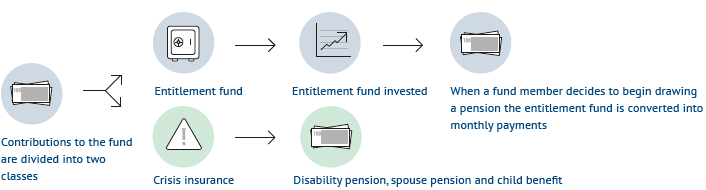

Fund members’ entitlements are directly linked to the Fund’s performance through a so-called asset index. The fund’s assets are estimated every month and entitlements updated in step with performance

Pensions

When a fund member decides to begin drawing a pension the entitlement fund is divided into monthly lifelong payments. A pension can be applied for from the age of 60.

Disability pension

If the ability to work is reduced by 50% or more resulting in a loss of income a rehabilitation or disability pension is provided.

Spouse pension

Paid to spouse on a fund member´s death.

Child benefit

Paid to the children of deceased fund members and the recipients of a disability pension.

Voluntary Division

You have a choice of paying 2-4% of your wage or salary to private pension savings. In this case, the employer makes an additional contribution of 2% which is equivalent to a 2% pay rise.

- Can be used tax-free to buy a first apartment or cover short-term mortgages

- There are three available investment portfolios

- Can be paid out after the age of 60

- Inheritable on the death of a fund member

Commencing private pension is a simple matter. An electronic application can be filled in on the Stapi website and the Fund ensures that the information is passed on to the employer. English application is also available in pdf.

Specific Voluntary Division

Many bargaining and employment contracts allow the allocation of up to 3.5% of mandatory contributions to a specific division. Subsequently this proportion results in lower entitlements with regard to pension and crisis funds.

- Can be used to buy a first apartment, depending upon certain conditions

- Can be paid out from the age of 62

- One investment portfolio

- Inheritable on the death of a fund member

A fund member who chooses this option must fill in a declaration on the fund´s website. If no action is taken the amount in question is automatically transferred to the Mandatory Division

Compare cost in Voluntary savings

You must take special care regarding the depositary of voluntary savings. Pension funds, banks and foreign organisations offer diverse investment options, the cost of which may vary.

Stapi does not claim the cost of contributions when these are paid to the fund, but annual operational cost is 0.2%-0.5% depending on the choice of investment option.

If voluntary savings are to be used to pay part of a mortgage or for the purchase of an apartment, this requires the specific permission of the depositary.

Entitlements are based on payments

Your entitlements with Stapi Pension Fund are based on payments received from your employer. It is essential, therefore, to ensure that contributions indicated on your payslip find their way to the fund so that your entitlements are not lost.

Twice a year, Stapi issues an overview of transactions, published on the fund members’ website and in the electronic mailbox of Ísland.is. Among other things, the overview indicates the proportions of your contribution and the employer´s counter-contribution as well as estimated pension entitlements. If you have any comments, or you feel that contributions have not been discharged, please contact us.

Fund members´web

The fund members’ web can be accessed via the Stapi website. Make sure that you have filled in the space under the heading My information (Mínar upplýsingar) to ensure that you receive notifications from us.

The fund members’ web contains all information regarding your employer’s payments to the fund. It is essential that you check whether a correct amount, based on your pay statement, has been paid to the fund. Here you can also access information on your entitlements from the fund.

Housing Loans

Stapi Pension Fund offers its members housing loans or loans for the refinancing of mortgages. Information on loan options can be accessed on the fund´s website. Inquiraies regarding housing loans can be sent by email to lan@stapi.is.

Q&A

- What is a contribution?

- Why are we obliged to pay into a pension fund?

- What entitlements do I acquire by paying into the fund?

- What happens if a fund contribution is withheld?

Answers to those and other questions can be accessed in icelandic at stapi.is and in english and polish at lifeyrismal.is

Investments

Stapi´s asset management is shaped by the fund´s investment strategy which is determined annually by the Board of Directors. The fund´s objective is to maximise yield with a view to acceptable risk-taking at any particular time. The fund has formulated a strategy of responsible investments and shareholder policy. Under the heading Investments at stapi.is you can retrieve information regarding the performance of all divisions as well as the fund´s strategies. The web also provides access to all pension-related information under the heading Fund Members.

You can make a difference

Stapi Pension Fund was created by the merger of the Pension Fund of North Iceland and the Pension Fund of East Iceland in 2007. The fund´s partner associations are the following workers´ unions: Afl, Aldan, Eining-Iðja, Byggiðn - Association of Construction Workers, the Akureyri Union of Retail and Office Workers, Framsýn, Samstaða Workers´ Union, Þórshöfn Workers’ Union, Skagafjörður Office Workers´ Union, Þingiðn and the SA Confederation of Icelandic Enterprise.

Pension funds are regulated entities operating in accordance with Act No. 129/1997 as well as complying with various other aspects of legislation, regulations and guiding standards. In addition, the pension fund operates on the basis of Articles of Association which, for example, comprise the foundation of the system of entitlements and a framework within which the fund discharges its duties. Articles of Association can only be changed at annual meetings.

Represetnative Council

A special representative council has voting rights at meetings. The fund´s partner associations elect representatives to the council which generally comprises members representing employees and employers. If you are interested in participating in the formation of the fund´s policies, do not hesitate to contact your partner association.

Office location

Stapi has two offices, in Akureyri and Neskaupstaður.

We recommend contacting us in case you have any questions or require further information, tel. 460-4500 or stapi@stapi.is.